The lowest Equity Release interest rate is currently 5.94% (MER) fixed for life. The highest interest rate in the market is 8.64% (MER). In the 2024 Q3 market data, the Equity Release Council stated that average advertised lifetime mortgage rate was 6.89% in October 2024.

In this guide, you will learn:

Our general rule is an interest rate at 5% excellent, 6% being average, and 7% plus being for more substantial borrowing with the most product features.

Let's take a look at a selection of some of the lowest interest rate products on the market:

| Lender |

Monthly Equivalent Rate (MER) |

Annual Equivalent Rate (AER) |

| LV |

5.94% |

6.10% |

| Just |

5.95% |

6.11% |

| Just |

5.99% |

6.16% |

The interest rate for your plan will have many determining factors, some of which we will explore later in this article.

While everyone's circumstances are different, we have compiled examples of clients we have helped and listed the interest rates applicable to their plans.

Single homeowner aged 61

| Property value |

£650,000 |

| Client looking for money to repay an existing mortgage and have access to further money to help with living in retirement. Property is of standard construction with a 20% flat-roofed extension. The client is currently out of work and is using credit cards to pay for daily living expenses. |

The recommended plan

| Lender |

more2life |

| Release |

£52,945 upfront + £30,00 in reserve |

| Interest rate |

6.00% MER (6.17% AER) |

| Lender Fees |

£0 upfront + £500 on completion |

Couple aged 71 and 73

| Property value |

£575,000 |

| The clients are looking for enough money to repay an interest-only mortgage and repay car finance. Clients would like to make payments towards the equity release interest owed and would like the option to downsize or repay, upon the death of the first borrower. |

The recommended plan

| Lender |

more2life |

| Release |

£201,250 |

| Interest rate |

6.78% MER (6.99% AER) |

| Lender Fees |

£0 upfront + £500 on completion |

Couple aged 76 and 77

| Property value |

£250,000 |

| Clients are looking for enough money to repay their existing mortgage and secured loans. Property is of standard construction and is an ex-local authority. |

The recommended plan

| Lender |

more2life |

| Release |

£92,000 |

| Interest rate |

6.48% MER (6.68% AER) |

| Lender Fees |

£0 upfront + £500 on completion |

To receive your personalised illustration, click here to request a quote.

There are many factors which contribute to the interest rate for your lifetime mortgage. These include:

Requested Loan to Value

The most significant impact on your interest rate is the amounts you require to borrow as a percentage of your property. Generally, the closer to the maximum available to you which you wish to release, the higher the interest rate.

Credit History

Your credit history can also affect the plans available and subsequent interest rates. If you have had County Court Judgments (CCJs) issued against you, or you have been made insolvent in the past, you can still get equity release. However, some plans with the best interest rates in the market may not be available.

Even if you currently have outstanding credit problems, you could still get Equity Release. Some lenders also offer the flexibility of allowing you to use the Equity Release to repay these debts.

Product features

All lenders have different product underwriting and various features on their plans. Products which have extra features, such as a reserve facility or inheritance protection, may mean you have to pay a premium for this with a higher interest rate.

Lending criteria can also have an impact on limiting the market for you. For example, if the lenders offering the best interest rate products don't approve of your property, you will have to choose a lender who will, which could be at a higher interest rate.

Some lenders also charge extra fees such as completion fees which are going to affect the interest rate. It is essential to understand the total cost of the plan over the estimated term, as sometimes plans with lower interest rates include other fees which may make the plan more expensive.

Age

Although your age doesn't directly affect the interest rate, it does affect the maximum amount you can borrow. This, in turn, affects the interest rate, as typically the closer you are borrowing to the maximum amount available, the higher the interest rate.

Let's look at an example:

At age 55, if you wanted to release 20.00% of your property value, the best interest rate would be 6.88% (AER).

At age 75, if you wanted to release 20.00% of your property value, the best interest rate would be 6.11% (AER).

Marital Status

Some lenders won't be available to you if you are married and want to take Equity Release in one name only. To have access to all plans, you would need to own and apply, in joint names.

Remember, lenders, use the age of the youngest applicant when working out how much you can borrow, and your associated interest rate. It may be that you could have a lower interest rate, or a more significant release by applying in one name.

When looking at Equity Release interest rates, you will notice some quoted as MER and others as AER.

But what's the difference?

AER stands for the Annual Equivalent Rate.

AER represents the rate of interest added over one year.

MER stands for the Monthly Equivalent Rate.

MER represents the rate of interest added over the year but divided over every month. The MER is often slightly lower than the AER.

Let's see why.

Lifetime mortgages usually do not require you to make any monthly payments. Commonly interest is calculated and added to the loan monthly, and if you are not making any payments, as the months' pass, your loan balance increases slightly more each month.

The table below illustrates how interest added monthly at an MER of 5.94% becomes an AER of 6.10%% at the end of the year if you make no payments. (Monthly interest added = AER / 12).

| Month |

Opening Balance |

Interest Charged |

Closing Balance |

| 1 |

£10,000.00 |

£49.50 |

£10,049.50 |

| 2 |

£10,049.50 |

£49.75 |

£10,099.25 |

| 3 |

£10,099.25 |

£49.99 |

£10,149.24 |

| 4 |

£10,149.24 |

£50.24 |

£10,199.48 |

| 5 |

£10,199.48 |

£50.49 |

£10,249.97 |

| 6 |

£10,249.97 |

£50.74 |

£10,300.71 |

| 7 |

£10,300.71 |

£50.99 |

£10,351.70 |

| 8 |

£10,351.70 |

£51.24 |

£10,402.94 |

| 9 |

£10,402.94 |

£51.49 |

£10,454.43 |

| 10 |

£10,454.43 |

£51.75 |

£10,506.18 |

| 11 |

£10,506.18 |

£52.01 |

£10,558.19 |

| 12 |

£10,558.19 |

£52.26 |

£10,610.45 |

If you are comparing any interest rates, it's essential to make sure you are comparing the same type to make sure it's an accurate comparison.

The majority of lifetime mortgage interest rates are fixed for life at the outset of the plan. This means you know exactly how interest is charged for the entire length of the plan, and you are not 'stung' if interest rates increase.

Variable rates for lifetime mortgages are similar to residential mortgages. Typically with lifetime mortgages, they are linked to the Consumer Price Index.

A lender who offers variable rate equity release is One Family, who states:

"Our variable rate lifetime mortgages are linked to the Consumer Price Index (CPI) and the CPI is adjusted each year in December according to the CPI displayed on the Office of National Statistics (ONS) website."

One of the Equity Release Council's rules is that for a plan to meet standards, all variable rates must have an upper cap to them. This offers a degree of certainty, as you know what the highest interest rate can be.

In recent times, we have mostly been recommending fixed interest rate products as these have often been lower than the variable rate plans, and offer complete certainty.

Please note: This product has been withdrawn from the market and all plans for new clients offer fixed interest rates.

However, if you have a reserve facility, any money drawn in the future will have its own fixded interest rate set to the prevailing rate at the time of request.

Lifetime mortgage interest rates fell to an all-time low following Covid; however, they have since largely normalised.

Here's a table showing how average lifetime mortgage interest rates have changed since 2015.

| Period |

Average Interest Rate |

| Jul-15 |

5.97% |

| Jan-16 |

6.20% |

| Jul-16 |

5.96% |

| Jan-17 |

5.45% |

| Jul-17 |

5.27% |

| Jan-18 |

5.14% |

| Jul-18 |

5.22% |

| Jan-19 |

5.21% |

| Jul-19 |

4.91% |

| Jan-20 |

4.48% |

| Jul-20 |

4.11% |

| Jan-21 |

3.95% |

| Jul-21 |

4.26% |

| Jan-22 |

4.16% |

| Aug-22 |

5.74% |

| Jan-23 |

6.73% |

| Jul-23 |

7.11% |

| Jan-24 |

7.00% |

| Jul-24 |

6.92% |

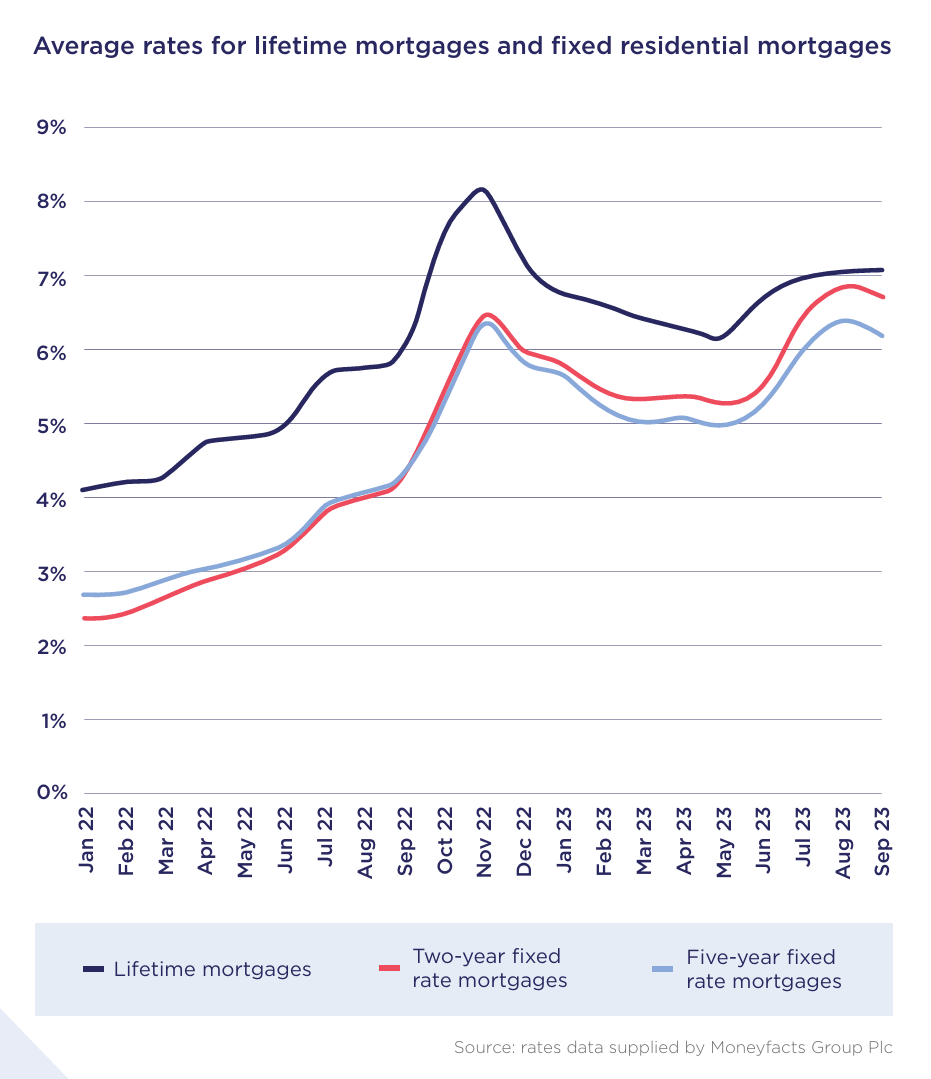

Let's look at a graph from a report produced by the Equity Release Council which shows how average equity release interest rates have changed over the last couple of years.

Equity Release interest rates largely follow movements in long-term GILT yields.

If the long-term GILT rate is rising, equity release interest rates will likely be rising too. However, if you see that the GILT rate is falling, it could be an indication that equity release interest rates will be falling too.

Long-term GILT rates are currently rising and so are equity release interest rates!

There is normally a lag in when equity release lenders reduce interest rates. However, when GILTs are rising, equity release interest rates will quickly be rising too.

You can track the latest movements in the U.K. 15 Year GILT here.

Let's look at how the 15-year GILT rate has changed by month:

Lifetime mortgage interest rates fell to record lows during 2020 and 2021 when a fixed-for-life rate of just over 2% was available. Now, interest rates start at 5.94%.

You can clearly see the lowest GILT rate in 2020, and equity release interest rates were at their lowest in 2020 and 2021.

You can also see the GILT rates rise sharply following the mini-budget in 2022. Unsurprisingly, equity release interest rates also sharply rose at this time.

With the new Labour government and the latest budget, GILT rates have increased again, and equity release interest rates are also increasing.

Equity release interest rates change constantly. Some equity release plans offer live pricing, so interest rates can even change throughout the day!

Although equity release advisors are qualified, we cannot indicate how GILTs will perform in the future.

If you want to understand more about how GILT rates impact equity release, you can read my full guide here.

While a qualified equity release advisor has written this guide, it is not intended to be used as financial and should not be relied upon.

Equity release is not right for everyone and may involve a lifetime mortgage or home reversion plan.

If you are considering Equity Release we recommend you read through is equity release right for me? carefully.

We have also created a Myth Buster for further useful reading.

Equity release can impact your entitlement to mean tested benefits and will impact the value of your estate.

To understand the full features and risks of an Equity Release plan, ask for a personalised illustration.

Did this article answer your question?

If you found this article interesting, why not share it with your friends?

Simply click on the icons below to share.